- SalesGoat

- Posts

- Origins of Y Combinator 🧶

Origins of Y Combinator 🧶

Edition 3: February 26, 2023

GM. This is SalesGoat. The weekly newsletter that brings you the latest hand-picked sales jobs from top tech startups.

Here’s what we’ve got for you today:

Origins of Y Combinator 🧶

10 hand-picked jobs 💜

$1B breakup fee ✨

Poetic and Bold: 2023 predictions ✨

CRO confessions ✨

(FUND)raising 💰️

Origins of Y Combinator 🧶

Jessica Livingston and Paul Graham crafted the idea for Y Combinator in March 2005 (almost called Cambridge Seed) walking through Harvard Square in Boston. They put in $100k and recruited computer scientist Robert Morris and entrepreneur Trevor Blackwell to each invest in $50k.

Jessica, Paul, Robert, Trevor after the first YC interviews, in 2005

The first YC batch launched that summer with $200k total, which eventually birthed Reddit. Paul and Jessica realized that Silicon Valley had a better startup density (not to mention better weather) so they moved the entire program to Mountain View for the next batch that winter and the rest is history.

Fast forward 18 years; 3,500 companies and 10,000 founders have graduated the three month startup incubator, creating companies like Stripe, Airbnb, Coinbase, Dropbox and Doordash. Collectively, YC graduate companies have a combined valuation nearing $1 trillion dollars. Paul’s original post on how he started YC.

One thing YC does incredibly well is giving back to the community. 👇️

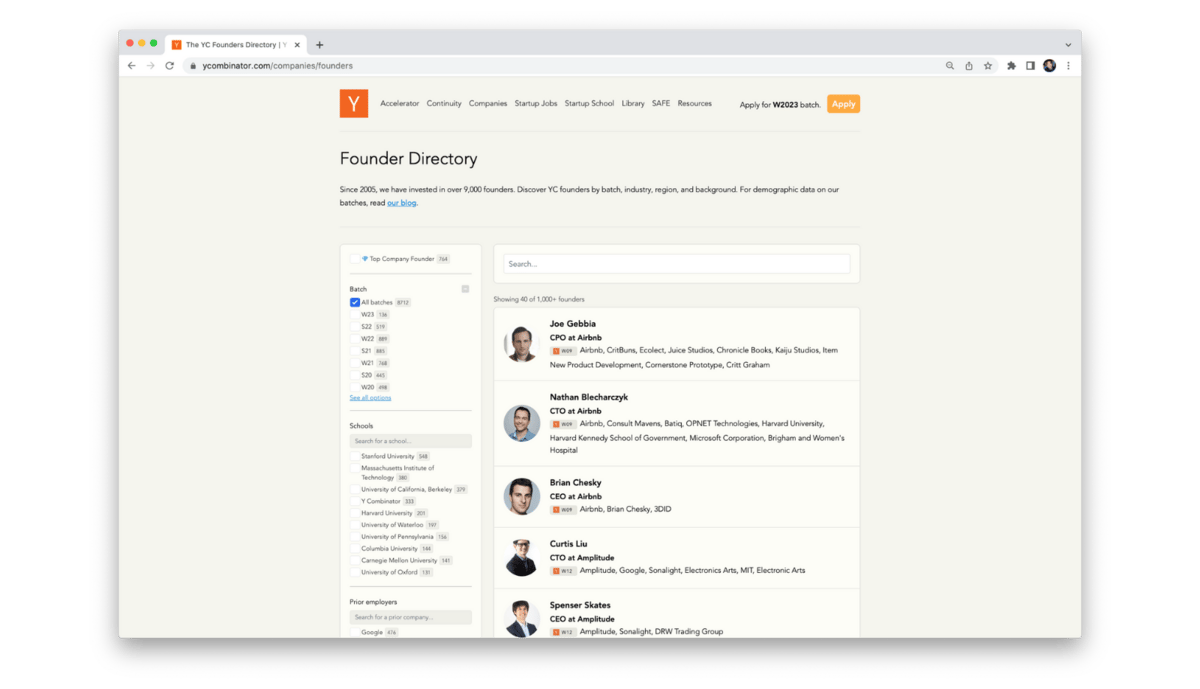

YC launched a YC Startup Directory so you can discover funded companies by batch, industry, region, and company size. You can create a hiring profile and express interest in jobs at each company.

Taking the company search one step further, you’re able to browse founders via their YC Founder Directory to discover who attended your university, worked at the same company, and are building (or built) a company in your region. You can also generate lists of YC founders by their role or the industry of their YC company.

10 HAND-PICKED JOBS 💜

Mutiny: Business Development Representative

🌍️ Remote

💰️ Backed by Sequoia, Tiger Global, Insight Partners

🦺 Apply here

Levro: Sales Lead, Go-To-Market

🌍️ Remote

🐐 Small, but mighty team (10 ppl)

🦺 Apply here

Alloy Automation: Business Development Representative

🌍️ Remote

💰️ Raised $27M, backed by 16z, Bain Capital, YC

🦺 Apply here

Stackadapt: Manager, Revenue Operations

🌍️ Remote

🐐 Support and simplify the sales process

🦺 Apply here

Scratchpad: Enterprise Account Executive

🌍️ Remote

🐐 Sell ACVs of $75k - $250k+

🦺 Apply here

Watershed: Outbound Enterprise SDR

🌍️ San Francisco

🐐 Founding member of the go-to-market organization

🦺 Apply here

Brex: GTM Enablement Lead

🌍️ Remote

🐐 Improve the productivity of the account management org

🦺 Apply here

Community Phone: SMB Account Executive

🌍️ Remote

🐐 Grew revenue 400% in 2022

🦺 Apply here

Human Interest: Senior Salesforce Administrator

🌍️ Remote

🐐 Work across Sales and Customer Support

🦺 Apply here

Transcarent: Director, Mid-Market Sales

🌍️ Remote

🐐 Closed series C in January 2022

🦺 Apply here

$1B BREAKUP FEE ✨

The Justice Department is preparing an antitrust lawsuit seeking to block Adobe's $20 billion acquisition of startup Figma. Good news for Figma users who probably don’t want to see the company integrated with Adobe. Bad news for founders and employees who saw Figma sell at the top and were about to get paid. I imagine Dylan Field and the rest of the Board taking a $1B~ break up fee from Adobe and setting their sites on an IPO in 2-4 years 🍿.

This feels a bit like the Plaid and Visa fiasco. Turns out the DOJ blocking the acquisition of Plaid by Visa was the best thing that could have happened to Plaid.

Imagine being Dylan Field

You bust your ass building Figma from scratch. You scale to $400M despite the impossible

Then Adobe offers to pay you $20B, creating one of the biggest paydays in history

Until the U.S. government says: “Nope. You must keep working, Dylan.”

— Warbucks (@therealjunto)

11:19 PM • Feb 23, 2023

POETIC AND BOLD: 2023 PREDICTIONS ✨

Josh Wolf Co-Founder of @Lux_Capital released their Lux LP letter sent to investors in Q4 2022. Every quarter this is a must read. Josh typically tweets it out , but it doesn’t make it’s rounds into your typical media outlets.

The opening is poetic and superb and provides some bold bets on what to expect in the markets, startup ecosystem and vc world in 2023 👇

Lux top 10 co’s have war chests nearing $5B of cash

MASSIVE misallocations + excess indebtedness built up Markets may FALL 30%+

Chaos in markets will create combinatorial possibilities of talent (voluntarily left or involuntarily laid off)

The costs to train foundational AI models will have equivalent of a Eroom’s Law or Rock’s Law (from $10M > $100M > $1B)

JAPAN role in global markets + possible selling of equities + bonds may cause major dislocations

CRO CONFESSIONS ✨

Sam Blond, Partner at Founders Fund and former CRO at Brex tweeted out his latest podcast where he discusses the current SaaS sales landscape and tips for hiring in 2023 with guest Ben Braverman, former Flexport CRO and CCO.

(FUND)RAISING GOATS 💰

Elaborate, the tool that doctors and their staff use to deliver contextualized, action-oriented lab results to patients, announced today it has raised $10 million in Seed funding. The funding round was led by Tusk Venture Partners, with participation from Founder Collective.

Hume AI, a NYC-based startup raised $12.7m in Series A funding from Union Square Ventures.

Andreessen Horowitz led the $16 million Series A investment in Method, wants to make it easier for fintech developers to embed bill pay automation into their apps.

Finley closed $17M to turn 100-page debt capital agreements into software-managed code. CRV led the round.

Rebellyous, a startup that’s striving to build “a better chicken”, think impossible foods, but for chicken nuggets has raised at least $20 million in fresh funding with participation from Liquid 2 Ventures.

GOAT MEME

That's a wrap for today. Stay thirsty & see ya next week! If you want more, be sure to follow our Twitter (@SalesGoatco)

Share SalesGoat

Or copy and paste this link to others: